Industrial Real Estate 2025: Smyth Group’s Predictions

As we approach 2025, the industrial real estate landscape is poised for transformation. At Smyth Group, we’ve identified the key trends shaping the market and present our predictions for the year ahead.

Market Recovery Gains Momentum

After a period of uncertainty and decreased market activity, the industrial real estate market is on the verge of recovery:

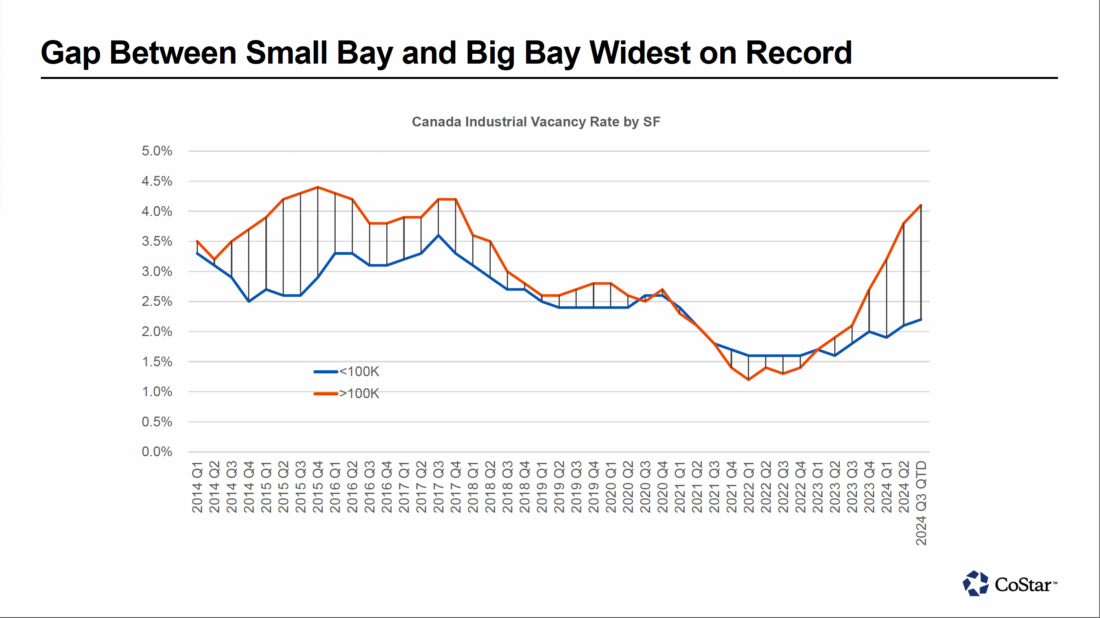

- Vacancy Rates: Vacancy rates have stabilized at 4.1% as of Q3 2024—the highest since Q4 2015—with expectations of tightening in prime submarkets by late 2025.

- Transaction Volumes: Transaction volumes are expected to rise as pricing stabilizes and pent-up demand is gradually released.

- Global Investment: A potential surge in foreign capital, particularly targeting industrial assets, could further fuel recovery.

Challenges on the Horizon

Despite positive momentum, the industrial real estate market faces notable challenges:

- Labor Shortages: Workforce constraints in construction and logistics remain a significant hurdle. With Canada’s unemployment rate at 5.9% (October 2024) and over 70,000 unfilled construction jobs nationwide, the industrial sector faces delays in development timelines and increased labor costs. A 20% decline in net immigration to Canada in 2023 further restricts workforce growth.

- Short-Term Overbuilding Risks in Big Box Market: The big-box market continues to face challenges with rising vacancy rates in high-supply submarkets. Milton-Halton Hills, for example, reports a vacancy rate of 10.5%, which is far above the GTA average of 4.1%. This oversupply, combined with a cooling demand for large-scale facilities, highlights the risk of overbuilding in areas unable to attract sufficient tenants. Conversely, smaller bay formats remain in demand, as highlighted by their below 2% average vacancy rate.

Evolving Demand Drivers

Economic and technological changes are reshaping demand across the industrial real estate spectrum:

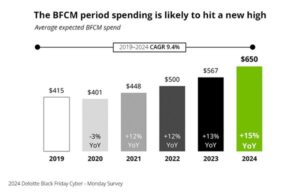

- E-commerce Optimization: Companies are streamlining logistics, keeping demand high for urban warehouses and last-mile delivery facilities. Black Friday-Cyber Monday spending is projected to grow 15% year-over-year and driving demand for strategically located industrial spaces. This trend tightens vacancy rates, raises rents in urban hubs, and boosts interest in purpose-built logistics facilities with advanced automation.

- Data Centers: Rising computational needs are driving demand for specialized facilities.

- Cold Storage: The growth of online grocery shopping is boosting demand for temperature-controlled storage.

Rental Rates and Pricing Trends

The rental market is showing promising signs of stabilization and growth:

- Stabilization in 2025: Average net asking rents, currently at $17.70 per square foot (Q3 2024), are expected to stabilize in early 2025.

- Growth in Key Submarkets: Tight markets like GTA North and GTA West are likely to see rental rate growth in Q3-Q4 2025.

- Challenges in Milton-Halton Hills: High-vacancy submarkets face ongoing rental pressure, with big-box rents dropping from $20.00 to $17.95 year-over-year.

Absorption and Leasing Activity

Leasing trends indicate recovery and renewed activity:

- Turning Positive: After three quarters of negative absorption, the market is expected to gradually improve in 2025

- Sub-50,000 Square Foot Activity: Smaller facilities are seeing consistent demand, driving leasing activity in this segment.

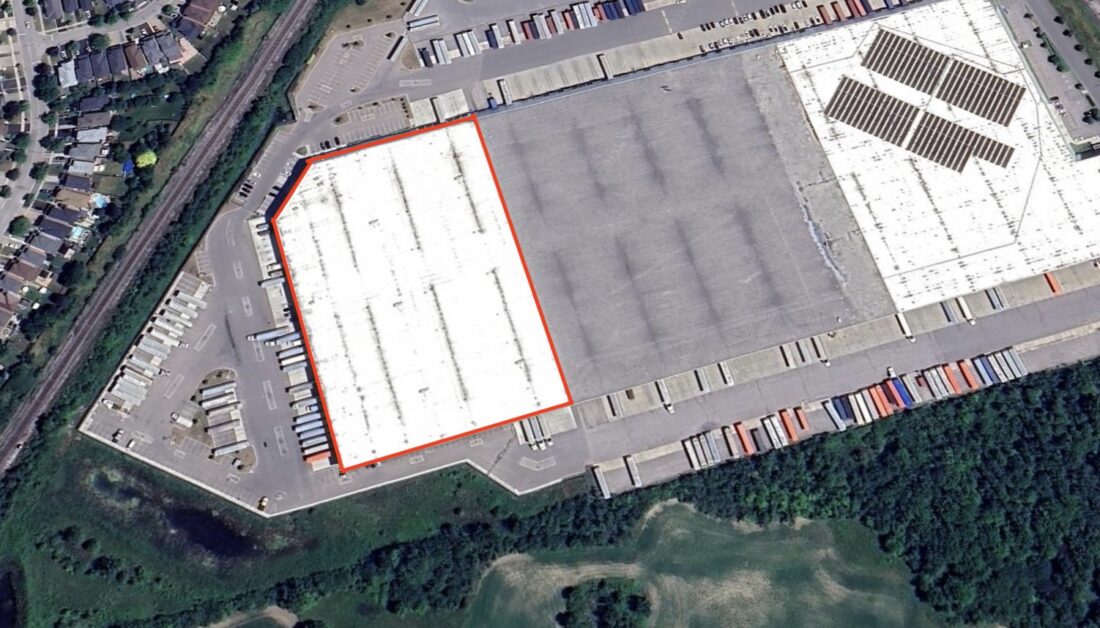

- Large Leases: High-profile deals, like Kruger Products’ 650,484 square foot lease in Whitby, highlight growing interest in larger spaces.

Construction and Supply Dynamics

Supply-side trends are shaping the market outlook:

- Pipeline Cooling: The construction pipeline is slowing, but at a less dramatic pace than initially projected.

- Speculative Dominance: Speculative projects account for 92.5% of developments in Toronto, though build-to-suit projects are gaining traction.

- Mid and Small-Bay Focus: Developers are prioritizing these segments, which remain extremely tight compared to the oversupplied big-box market.

Evolving Investment Strategies

Investors are adjusting their approaches to align with market realities:

- Niche Properties: Growing interest in data centers and cold storage facilities.

- Value-Add Focus: Investors are increasingly focused on value-add opportunities, prioritizing operational excellence and flexible, adaptable assets.

- Resilience: Prioritizing properties with strong fundamentals to weather market shifts.

Conclusion

At Smyth Group, we are optimistic about the future of industrial real estate in 2025. With signs of stabilization, evolving demand drivers, and opportunities in niche markets, the sector offers exciting potential for investors and developers. Success will favor those who adapt to shifting conditions, leverage technological advancements, and prioritize sustainability.

For expert guidance on navigating this dynamic market, the Smyth Group team is here to support your investment journey. Stay tuned for more insights as we monitor trends and their implications for the industrial real estate sector.