Canada’s Industrial Market: Navigating Adjustment and Continued Growth

By Spencer Smyth

- The industrial market remains a bright spot in the Canadian economy, demonstrating resilience despite broader economic challenges.

- The trend towards larger spaces with higher clear heights reflects the changing needs of occupiers, driven by e-commerce, supply chain shifts, and inventory strategies.

- The surge in new supply is a key factor shaping the current market, but construction activity is moderating, suggesting potential easing of supply pressures.

- The Canadian industrial market is well-positioned for continued growth, supported by structural factors and ongoing demand.

- The Canadian industrial market is currently in a fascinating period of adjustment, balancing economic headwinds with persistent demand and evolving logistical needs. Let’s break down the key factors shaping this dynamic landscape.

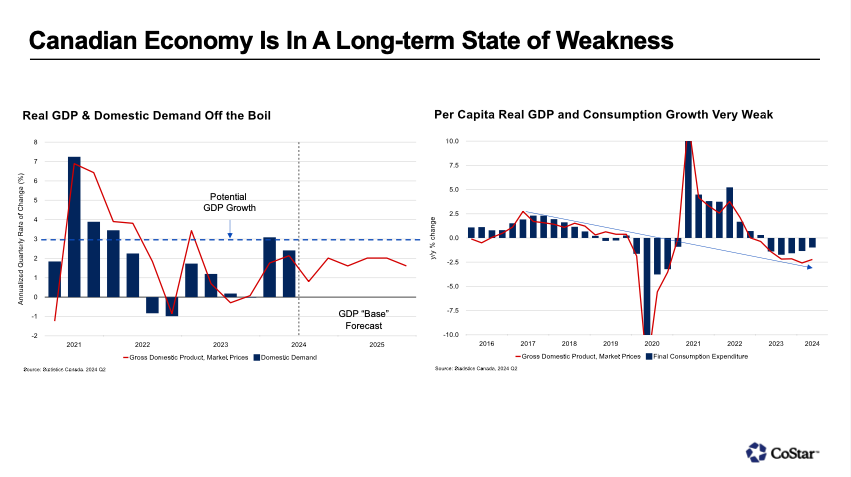

Economic Undercurrents

While the industrial sector demonstrates resilience, it’s crucial to acknowledge the broader economic context. Canada faces challenges with slowing GDP growth, weak domestic demand, and a concerning decline in the employment rate. These factors create a nuanced backdrop for industrial market activity.

Shifting Industrial Landscape

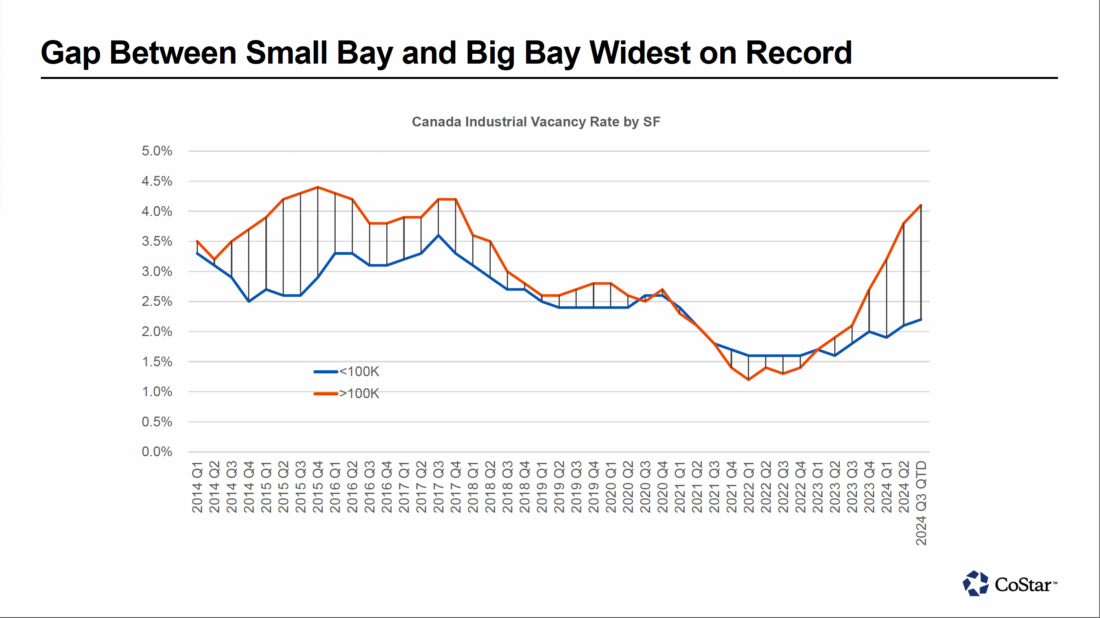

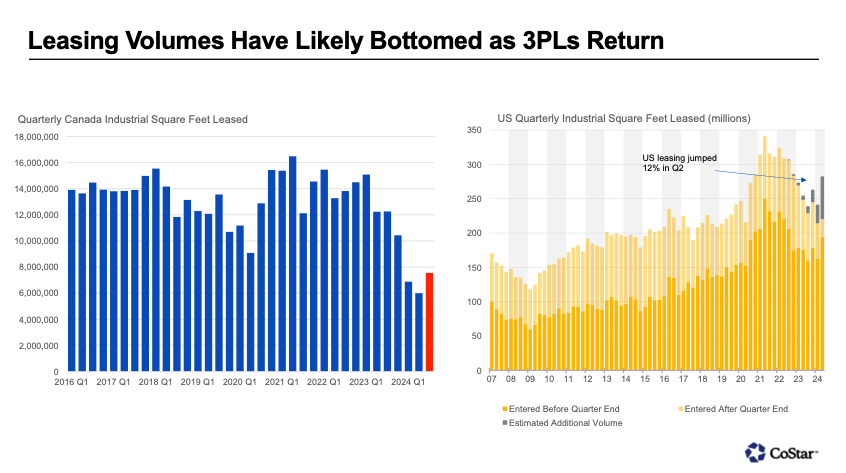

Despite the economic undercurrents, the industrial sector remains robust, driven by long-term trends in e-commerce, supply chain restructuring, and a growing emphasis on efficient distribution. This demand is particularly evident in the continued preference for larger industrial spaces with higher clear heights, accommodating modern logistics and “just-in-case” inventory strategies.

Supply and Demand Dynamics

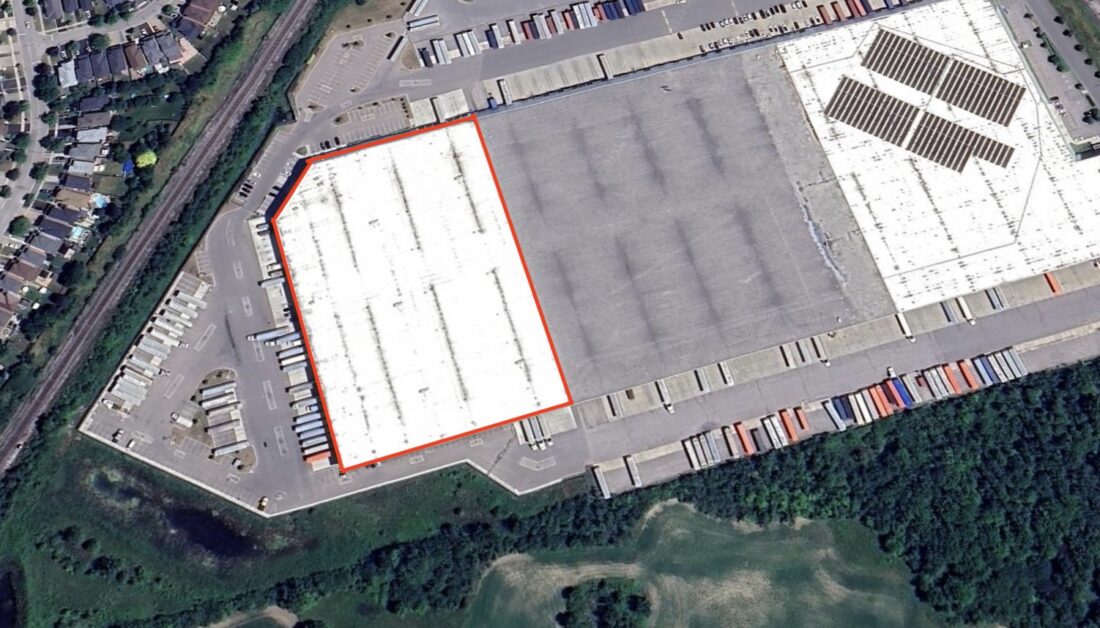

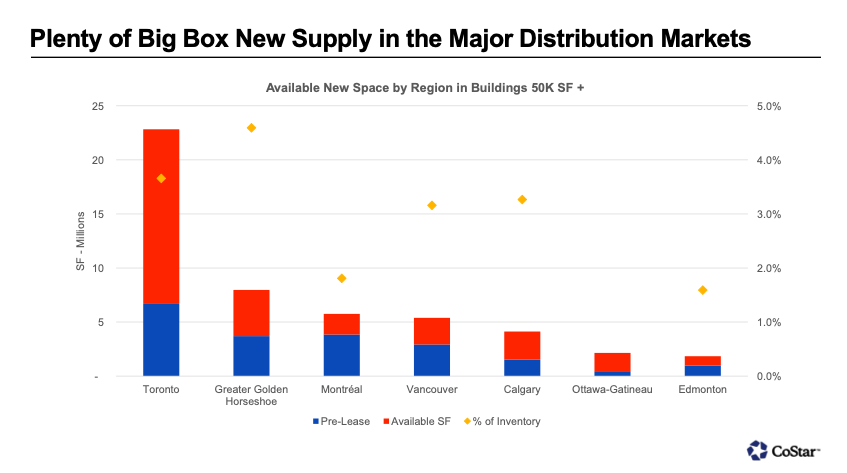

A surge in the delivery of big-box distribution centers, especially in key markets like Toronto, Montreal, and Vancouver, is a defining feature of the current market. This influx of new supply contributes to rising availability rates, particularly in Toronto and Calgary. However, it’s important to note that this increase is concentrated in properties with higher clear heights, aligning with the evolving demands of occupiers.

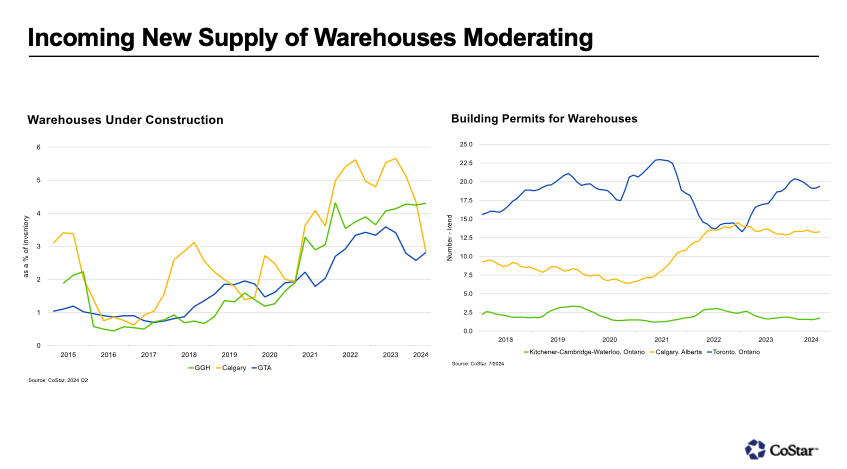

Moderating Construction Activity

The pace of new warehouse construction is showing signs of moderation. While fluctuations exist, building permits for warehouses have peaked in Toronto, and activity in other regions like Calgary and Kitchener-Cambridge-Waterloo remains relatively stable. This suggests a potential easing of supply pressures in the coming months.

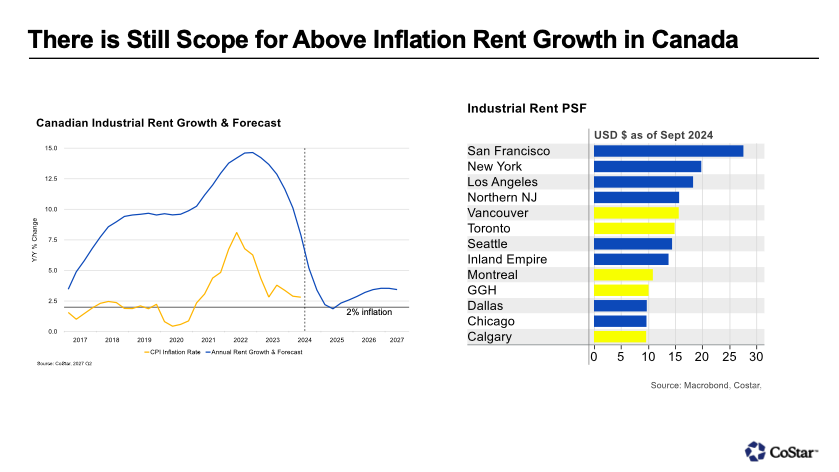

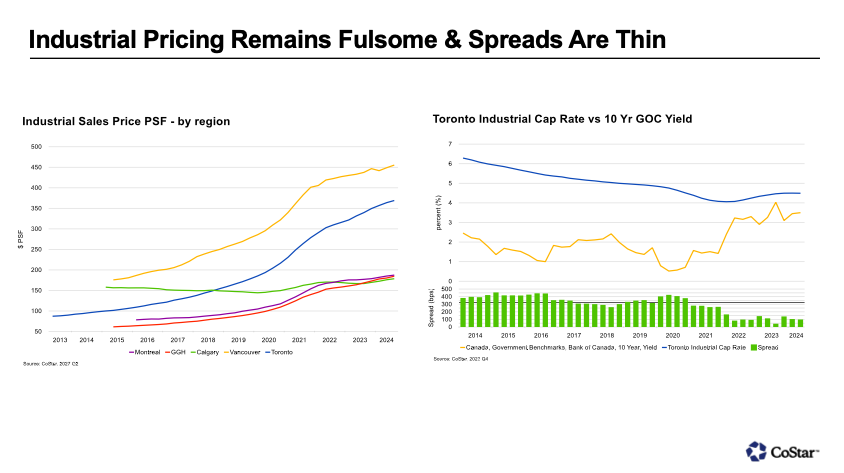

Resilient Rents and Investment

Despite some softening in rents for larger spaces, the overall outlook remains positive. There’s still room for above-inflation rent growth in Canada, and the market is expected to favor landlords in the long run. Investment activity in the industrial sector continues to be strong, with sales volumes and pricing holding firm.

Navigating the Short-Term, Embracing the Long-Term

The Canadian industrial market is expected to navigate the current surge in supply over the next year, with vacancy rates likely peaking in 2025 before compressing again. While adjustments are underway, the long-term outlook remains positive. Structural supply constraints, ongoing demand for logistics and retail space, and the sector’s adaptability to evolving needs underpin its continued growth trajectory.

Resources:

Chief Economist, Carl Gomez. Co-Star